Impact Pathway

Tailored funding solutions to accommodate the diverse requirements of different businesses.

In the form of Non-Dilutive Capital with more control in managing its capital structure.

Tech empowered underwriting capabilities and post disbursement monitoring systems.

Clear identified cashflows to be escrowed against which upfront investment can be availed. Collateral may be sought on a case to case basis.

Robust network comprising reputable Financial Institutions, resulting in optimization of borrowing costs for the customer, alongside prospective opportunities for capital enhancements.

The Partners have established wide-ranging industry networks, cultivating relationships with a substantial portion of key industry stakeholders. This affords our customers the opportunity to leverage these valuable connections at critical junctures in their business journeys, benefitting from access to established players, industry insights, and potential growth opportunities

Pre-provisioned returns highlighted

Pre-provisioned returns highlighted

Guidance only - Blended IRRs would be significantly lower than what is

indicated above due to benefits of Aquilon’s ecosystem passed onto

portfolio companies

Guidance only - Blended IRRs would be significantly lower than what is

indicated above due to benefits of Aquilon’s ecosystem passed onto

portfolio companies

Tech driven approach expedites our decision making

Tech driven approach expedites our decision making

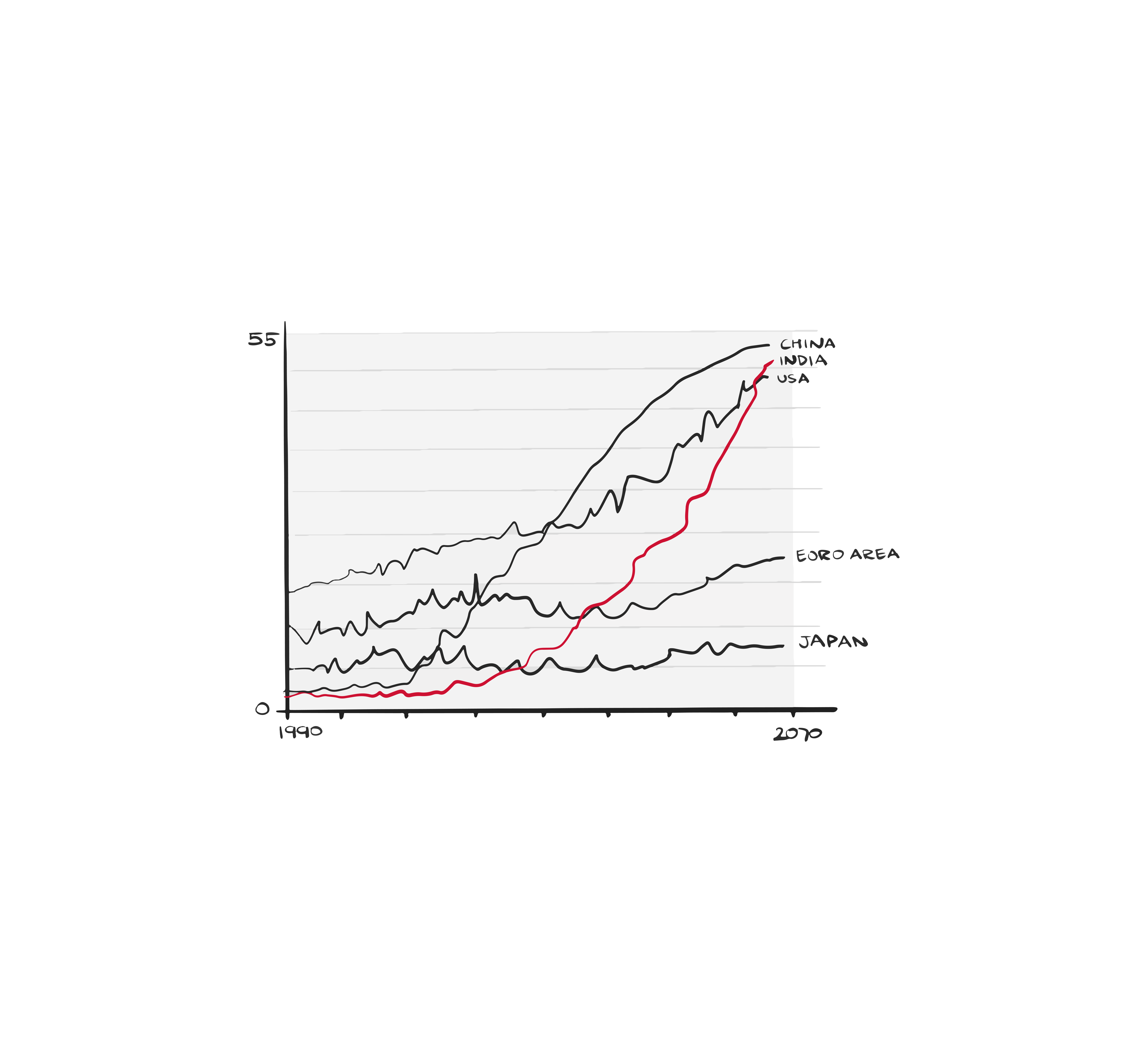

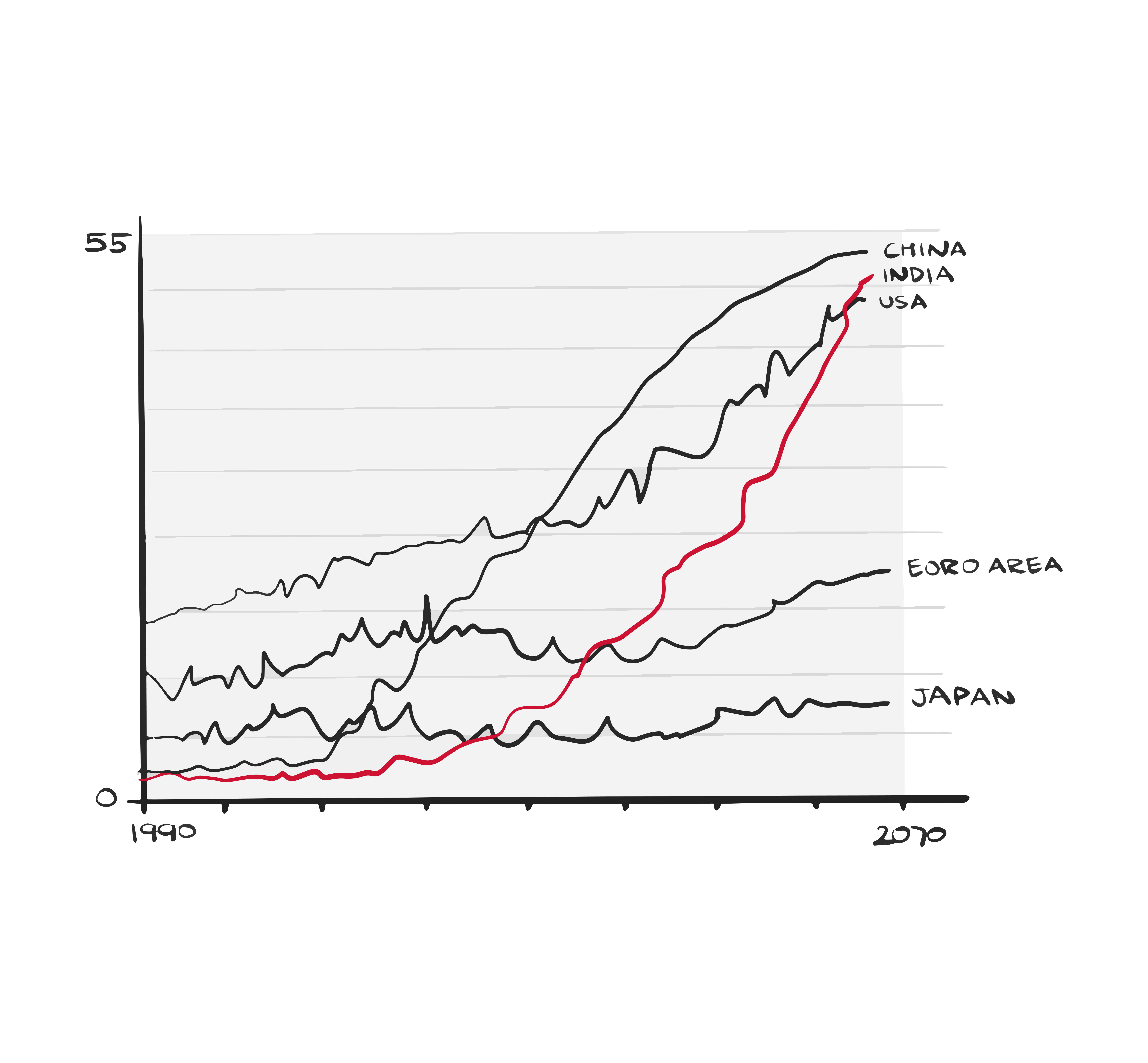

Currently the fifth largest economy, India is expected to become a $5 trillion economy by 2026. India has made more progress in innovation and technology than some realise, which when coupled with favourable demographics become the significant growth drivers for India to have the second largest economy in the World with a projected GDP of USD 52.5 trillion by 2075.

Source: Goldman Sachs, 2023

As of January 2023, only 14% of small and medium enterprises in India have access to credit in contrast to over 30% in developed nations. The credit gap is estimated to be around $530 billion. The whitespace is greater for small ticket size borrowers of $1 million and lesser. 70% of small ticket segment requirement is unmet amounting to almost $120 billion.

Source: RBI Annual Report, 2023

Startup investments continue to thrive, albeit with smaller deals and more balanced valuations. With India dedicated fundraises still at an all time high, businesses operating with strong fundamentals are not anticipated to face a dearth of investment. In fact, as investors and founders accept the new normal, it is also an opportunity for the more sustainable businesses to emerge stronger.

Source: India Trend Book 2023, IVCA and EY