Creative

Conscious

Custom-made

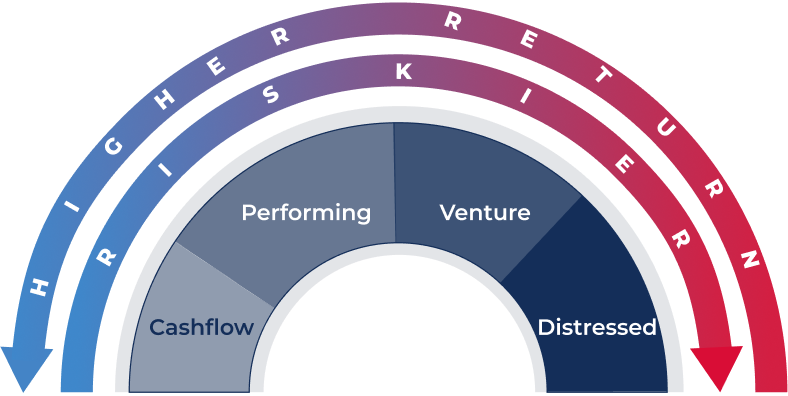

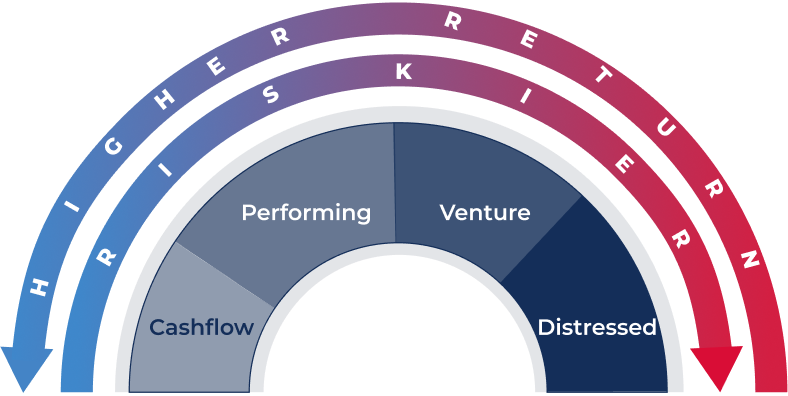

As a Private Credit fund, ACES provides structured credit solutions, secured by identified cashflows for fundamentally strong and scalable businesses in Sunrise sectors. The Fund's underwriting philosophy adopts a Cashflow Linked Repayment system integrated with a Tech-Enabled approach, and Innovative Transaction Structures while focusing on the core operational strength of Emerging Businesses. Aquilon's Entrepreneur-friendly, Cashflow based Credit strategy delivers the versatile capital imperative for Emerging Businesses to leapfrog from a steady-state into a realm of accelerated growth.

At Aquilon, we are committed to going beyond monetary support and serving as an Impact Partner for businesses in their growth journey.

View More

View More

Structured Credit is a specialized product designed to provide customized capital solutions to meet the distinct requirements of emerging businesses. Through this offering provides a flexible financing arrangement where we engage in a co-lending structure alongside a prominent Partner Institution and Anchor Investors. By adopting this collaborative approach, borrowers can benefit from an economically advantageous blended cost of investment.

This facility is primarily secured by the cashflows generated by the borrowing businesses, bolstered by appropriate credit enhancements. By leveraging this structure, we ensure that businesses have timely access to the necessary funds. Our aim is to provide emerging businesses with a comprehensive and well-tailored liquidity solution that supports their growth and financial stability.

Cashflow based Financing assists businesses in augmenting their working capital and bridging short-term cashflow gaps. The primary objective of this offering is to provide timely capital support to businesses without negatively impacting their ongoing operations.

The repayment mechanism is structured as Equal Principal Installments (EPI), ensuring that the repayment schedule is manageable and does not place undue strain on the day-to-day functioning of the business. By adopting this approach, we aim to provide businesses with the necessary liquidity to meet their immediate financial needs while maintaining a sustainable cashflow.

Our goal is to enable businesses to optimize their working capital, effectively manage their cashflow requirements, and ensure smooth operations. Through this offering, we strive to be a reliable partner in supporting the short-term financial stability and long-term growth of businesses.